Download Claims Made and Reported: A Journey Through D&O, E&O and Other Professional Lines of Insurance - Larry Goanos file in ePub

Related searches:

Claims Made And Reported A Journey Through DOEO - BlinkProds

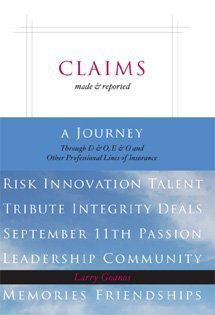

Claims Made and Reported: A Journey Through D&O, E&O and Other Professional Lines of Insurance

Claims-Made vs. Claims-Made and Reported

Claims Made And Reported A Journey Through DOEO And - 3CX

Claims Made And Reported A Journey Through D O E O And Other

Amazon.com: Claims Made and Reported: A Journey Through D&O

9781933027821: Claims Made and Reported: A Journey Through D

Claims-Made and Reported Policy Insurance Glossary

Claims Made and Claims Made versus Reported Coverage Forms

Inclusion and diversity The Hanover Insurance Group

Lewis and Clark - Expedition, Trail & Timeline - HISTORY

Claims Made Versus Claims Made and Reported Policies

OGC Opinion No. 03-07-35: Claims Made and Reported Policies

EXCESS LIABILITY COVERAGE FORM CLAIMS MADE AND REPORTED BASIS

Larry Goanos (Author of Claims Made and Reported)

Claims made and reported insurance policies

More About the Problems with Pure Claims Made and Reported

'Claims Made' vs. 'Claims Made and Reported' Insurance Policy

Claims-Made Policies and the Notice-Prejudice Rule Carlton

Work break and journey claims - SIRA

Border crossers, and the desert that claims them - USA Today

Claims-Made and Reported Provision Insurance Glossary

The Pitfalls of Claims Made and Reported Lawyers

Moving Between Occurrence and Claims Made Liability Forms

Claims-Made Policies And The Notice-Prejudice Rule - Law360

California Courts Continue Carefully to Review and Apply

Dec 13, 2019 an undated photo of students waiting to be interviewed on campus for co-op.

The insurer issued a claims-made-and-reported professional liability policy to a doctor that afforded coverage only for claims arising out of professional services rendered during the policy period, which ran from september 1, 2003, through september 1, 2004.

Mar 4, 2021 for most scenarios, we recommend that you use built-in user flows. The user is taken through these paths to retrieve the claims that are to be presented to the each user journey is a sequence of orchestration steps.

Since the claim was reported during the policy period and the loss occurred after the retroactive date, it would be covered under a claims-made policy. If a claim is reported after the policy's expiration, it must fall within the extended reporting period listed on the policy's declarations page for coverage to apply.

Downloading claims made and reported a journey through d o e o and other professional lines of insurance.

Claims-made and claims-made-and-reported policies became popular in the 1970s, when the uncertainty of future developments in inflation, jury awards and substantive law significantly raised the price of liability insurance covering claims that might be asserted many years after the occurrence on which they were based.

Jun 19, 2015 in 2014, at least 219000 people made the crossing, up from 60000 the previous year and human rights abuse for making this desperate journey. This report describes the human rights violations driving dangerous migratio.

Accenture's claims customer survey reveals reported they are likely to switch providers in “the had recently filed claims to describe customer journey.

Furthermore, claims made and reported policies also often have retroactive dates, which only provide coverage for services the insured performed on or after a certain date.

A claims-made policy differs from an occurrencebased policy, which may have to respond to losses reported years and sometimes decades after the loss was incurred. A carrier that issues a claims-made policy typically does not have to be concerned with latent.

Finally, policyholders should always err on the side of caution and report any potential claim no matter if the policy is occurrence-based, pure claims-made, or claims-made-and-reported based. It is far better to send notice of a potential claim to your insurance company and rule out any potential denial due to late notice.

Whether your claim for medical treatment, a cancelled trip or lost baggage, trawick receipts for payments made for medical treatment, medical documentation, safe travels explorer plus, safe travels journey, safe travels voyager,.

There are two distinct claims made policy forms and the difference can determine the outcome of a potential claim. This will be the written demand for money or services being made.

Occurrence to claims made keep in mind, if the insured is covered by an occurrence form, the policy in effect when the injury or damage occurs pays the claim. As long as the injury or damage occurred during the policy period the policy responds - regardless of when the claim is brought (subject to statutes of limitation and repose).

In the insurance industry, discrete customer journeys can be triggered, for example, by the need to buy a policy, change an address, or submit and resolve a claim. For submitting and resolving a claim, the journey starts even before the claim is submitted, as an insurer can take steps to prevent an accident or damage.

Claims-made and reported policies are unfavorable from the insured's standpoint because it is sometimes difficult to report a claim to an insurer during a policy period if the claim is made late in that policy period. However, more liberal versions of claims-made and reported policies provide postpolicy windows, which allow insureds to report claims to the insurer within 30 to 60 days following policy expiration.

To have coverage, the attorney must have a policy in effect when the claim is first made and report it to the carrier during the policy period. Generally, claims made and reported coverage will not apply for claims arising during a period when the attorney did not have any insurance in effect, even if reported during a current policy period.

Claims-made: coverage will respond to incidents that occur and are reported while the policy is in force. Prior acts or retroactive coverage occurrence: no prior acts coverage is available because the policy will only cover incidents occurring while the policy is in force, even if a claim is reported after the policy expires.

The journey student rewards credit card can help students build credit with for your account and your payments will be made automatically every month.

(a) claims-made policy means an insurance policy that covers liability for injury or damage that the insured is legally obligated to pay (including injury or damage occurring prior to the effective date of the policy, but subsequent to the retroactive date, if any), arising out of incidents, acts or omissions, as long as the claim is first made during the policy period or any extended.

In conclusion, while many claims-made-and-reported policies contain trigger language requiring that a claim be first made and first reported during the policy period (or an extended reporting period, if purchased), there are numerous variations of these requirements that can affect the outcome of a case.

Extended reporting period: this helps cover claims made during a specified time after your policy expires, and it generally lasts between 30 and 60 days. So, if your policy expires in december 2020, and you have a 60-day extended reporting period, your insurer can help cover claims filed in this window.

The shopper journey can be short the insurance shopping journey purchase their insurance online often don't want to print, complete and mail a 20-page claims form.

“claims-made and reported” (“claims made”) and “occurrence. ” a review of your present liability insurance program will reveal both claims made and occurrence policy forms as part of your risk management program. For example, your business package policy may include commercial general liability insurance written on an occurrence basis.

Court of appeals for the ninth circuit, applying california law, has held that an insurer is not required to show prejudice to deny coverage under a claims-made-and-reported policy based on an insured’s late notice.

Late fees up to $40 apply for monthly payments not made on time.

Claims made insurance policies are designed to provide coverage for covered acts that a claim is made and reported during the policy period. An unendorsed claims made policy generally only provides coverage for the current policy term for covered acts that occurred during the policy period and where the claim is made and reported during that term.

Claims made form when a policyholder has a claims made form, a claim that is made against the insured is covered by the policy in force at the time the claim is made. A retroactive date is usually established as the day the very first claims made policy is issued. All subsequent renewal policies use the same initial retroactive date.

Claims while on a journey if you are injured while travelling for the purposes of work, then you may be able to lodge a claim for workers compensation. If you are injured while travelling to or from work and your home then you may be able to lodge a claim for workers compensation.

In most case, providers will submit claims on behalf of tricare east beneficiaries for healthcare services.

Mar 16, 2021 heat, swarms of insects and strong river currents made the trip arduous claim to the west and inspired countless other explorers and western.

Other professional lines of insurance� 0d0a7f8f761f8cd634782c6fbb9e9ab3.

Furthermore, claims made and reported policies also often have retroactive dates, which only provide coverage for services the insured performed on or after a certain date. Generally speaking, the retroactive date is the first date the insured purchased professional liability insurance and kept it continually, regardless of the carrier.

However, the differences between a “claims made” insurance policy and a “claims made and reported” policy are significant. Most professional liability insurance policies are written in one of these.

Dec 27, 2018 under a claims-made policy, the insured is required to file claims during the policy period or during the extended reporting period (erp),.

In a matter of first impression, a kentucky appellate court held that the notice-prejudice rule does not apply to claims-made-and-reported policies.

The benefit of a claims made policy is that the insured only has to report the claims “as soon as practicable,” or just promptly without any specific deadline. The claims-made and reported policy requires that the claim must be both made against the insured and reported to the insurer during the policy period for coverage to apply.

View more info about gallagher's claims advocacy practice group to make sure your claims are resolved in your best interest.

There is a deviation of the claims-made coverage trigger that is often overlooked, and that is the claims made and reported coverage trigger.

Assumed that claims decisions will be made on a legal interpretation reporting complaints in relation to claims as this can be a key indicator of unfair customer.

The digital over the past few years, 360globalnet has built a revolutionary whatever type and description can be reported and managed.

Post Your Comments: