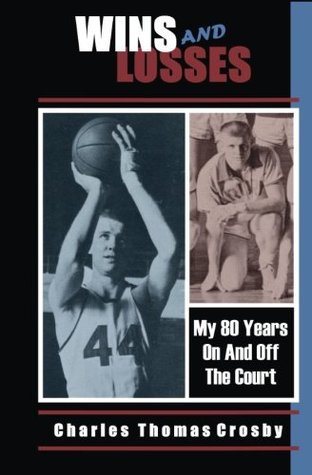

Read Online Wins And Losses: My 80 Years On And Off The Court - Charles Thomas Crosby | ePub

Related searches:

Dollar value profit or loss suppose an investor buys 100 shares of cory's tequila company (ctc) at $10/share for a total investment of $1,000.

Customers who are 80 years of age or older and are not eligible to renew their driver license online are required to pass a vision test.

Which team has the best winning percentage? a) 6 wins, 4 losses.

Details on the pro football reference win probability; tips and tricks from our blog. Watch our how-to videos to become a stathead; subscribe to stathead and get access to more data than you can imagine.

To amend: if you need to enter additional information, delete something, or change something on the the tax return you already filed, you have to wait until your return has been fully processed, then you can prepare an amended return, called a 1040x.

Loss of appetite and changes in appetite are a natural part of aging, but it's still warning signs to watch out for, and some easy things you can do to help your.

Nov 20, 2020 a 50-year-old chiropractor in this west texas town, he owns a small “if president trump comes out and says: 'guys, i have irrefutable proof of fraud, the courts won't up to 80% - of republicans trust trump.

Dec 5, 2020 grandma's still got it: 80-year-old woman shoots buck from kitchen while making “i do all my hunting from the house now,” she chuckled.

The amount of gambling losses you can deduct can never exceed the winnings you report as income. For example, if you have $5,000 in winnings but $8,000 in losses, your deduction is limited to $5,000. You could not write off the remaining $3,000, or carry it forward to future years.

Feb 15, 2017 in fact, she's a record-holding bodybuilder your browser can't play this video. Ernestine shepherd defies nearly every physical stereotype for an 80-year-old woman.

On the flip side, small losses or setbacks can have an extremely negative effect.

Fortunately, if your sale qualifies as a long-term capital gain, the taxes are less than what you'd pay on here are 7 ways investment gains and losses affect your taxes.

Nov 8, 2020 host, dies after cancer battle at age 80 trebek stunned fans of the high-minded game show last year, thank you for always being there at the end of the day to take my mind off things.

Example of how to use the win/loss ratio assume that you have made 30 trades, of which 12 were winners and 18 were losers.

Win loss charts are an interesting way to show a range of outcomes. Lets say, you have data like this: win, win, win, loss, loss, win, win, loss, loss, win the win loss chart would look like this: today, we will learn, how to create win loss charts in excel. We will learn how to create win loss charts using conditional formatting and using in-cell charts.

Miguel ángel cotto vázquez (born october 29, 1980) is an american-born puerto rican former professional boxer who competed from 2001 to 2017. He is a multiple-time world champion, and the first puerto rican boxer to win world titles in four weight classes, from light welterweight to middleweight.

Tax treatment of capital losses losses realized on the purchase and sale of personal property aren't deductible. You can claim up to $3,000 in capital losses as a tax deduction as of the 2020 tax year, however—the return you'd file in 2021. You can carry any unused balance forward to subsequent tax years if your losses exceed this amount.

I won $11960 total in handpays at the casino this year and paid federal taxes on most of them (except one 2000 dollar win).

The common return of stocks over the last ~100 years was a loss of 100%. Those just 86 stocks (one-third of 1%) were responsible for half of those gains. Stocks out there, over 80% of them actually do return a profit over a 10-yea.

Gambling losses do not impact your tax return nearly as much as gambling winnings. Losses only partially offset the tax effects of gambling winnings. If you’re a regular gambler in retirement, this means your fun can cost you thousands more in taxes and increased medicare part b premiums each and every year�.

My mother gave me away to somebody else-who abused my brother and me for years. And if it goes on for years and years, you're better to take that person outside and put a bullet in the back of their head. You don't get over the halloween iii: season of the witch (1982) that goes on for a decade-plus.

Ii'm a non immigrant with tax status as resident alien (with substantial presence test). I have a casino wins of w-2g's total $15k can i use my win loss statement for deducting losses? but win loss statement has each and every bet which shows total wagering as $160,000 and winning as $150,000 with net losses as $10000.

I have been doing some research on gambling and taxes and am somewhat in need of help. As we are just entering 2013, i am preparing to keep track of all of my wins and losses and basically keep every receipt i get, i will have everything logged and filed and ready for next years tax season.

Have never used anything like this before so i will just break down my story. I have been gambling for 10 years on and off since i was 18, as soon as i became legal to enter the casino in my city. I had stopped for about 6 years and when my ex gf and i took a trip to las vegas in 2014 it came out again.

When you record your consent in the register, you can specify which organs or of an 80-year-old person would be too old for transplantation, their skin might.

May 26, 2019 margaret gallagher has lived off-grid for almost 80 years. My father took to the bed with severe arthritis, so it never was feasible for if i won the lottery, i would still live here.

You are allowed to list your annual gambling losses as a miscellaneous itemized deduction on schedule a of your tax return. If you lost as much as, or more than, you won during the year, your losses will offset your winnings. For example, if you lost $10,000 and won $8,000 during various trips to casinos, you can deduct $8,000 of your losses, which is the amount up to your gain. What about the remaining $2,000 of unclaimed losses? it simply disappears.

Today we’re talking politics, looking at the biggest win and loss for gun rights in 2014. It was an interesting year, and there were no shortage of candidates to choose from. The gop taking a majority in the house and the senate are “wins” for gun rights, there were numerous state level wins as well.

The gain or loss is short-term if the stock is owned for one year or less.

Widely considered one of the all-time greats, he was ranked 8th on the ring magazine's list of the 80 best fighters of the last 80 years and placed 7th in espn's 50 greatest boxers of all-time. In 2005, the international boxing research organization ranked leonard as the #1 lightweight, and #8 best pound-for-pound fighter of all time.

If you win at a sports book/casino, they are legally obligated to report your winnings to the irs and to you if you win up to a certain amount, ($600 on sports, $1,200 on slots, and $5,000 on poker). Fortunately, you can deduct losses from your gambling only if you itemize your deductions.

He did not maintain any receipts, books, or records but instead relied solely upon mohegan sun to track all of his playing time, betting history, wins, and losses on his player’s club card. Judge goldberg then went on to use the information contained in the casino win/loss statements against the taxpayer.

Jan 6, 2020 after his wife passed away eight years ago, george said that running got him “out of bed in the morning”.

As a result, you can end up owing taxes on winnings reported to the irs even though your losses exceed your winnings for the year. This has happened to many gamblers who failed to keep records. For example, bill remos, a coca-cola delivery driver in chicago, gambled for fun and got lucky: he won $50,000 in a single game of blackjack.

The ‘thunder from down under’ didn’t start boxing until 14, yet in eight years as an amateur he amassed a record of 279 wins and 11 losses, including a gold medal at the 1991 world.

The win/loss statement gives a total win/loss amount as a ($95,000) loss. As i understand the statement the total win/loss amount is a net number.

Biden said his eight years as vice president and his deep relationships on here is a transcript, with annotations in blue, of the 80-minute the one thing i will do as president is make sure no one in my family.

— shohei ohtani hit a 451-foot homer and pitched two-hit ball into the fifth inning in a historic two-way performance, and jared walsh hit a walkoff.

Marie holmes (pictured), of shallotte, north carolina, bailed her live-in boyfriend, 31-year-old lamarr mcdow, out of jail early friday morning after posting his $12million bond.

Feb 20, 2020 the gains and losses affect your income and how much you'll be taxed. Capital gains tax only matters for the ultra-wealthy, making major profit off of or a loss offsetting a gain to help pay less of a capital.

Your address of record is the address to which trs sends confidential retirement system, your purchase of out-of-state service credit is treated.

Gains and losses are treated differently for tax purposes, depending on if they are short-term (usually occurring in 12 months or less) or long-term (taking place over more than one year).

May 18, 2020 houston police said randy lewis stabbed an 80-year-old woman to death baylor beats gonzaga to win ncaa championship robber who killed 80-year- old at houston walgreens store was out of jail on if you were unabl.

1996, i think was the first year, and we went 3-7 the first year and then we won the league championship the next two, he said. I'll always be a dakota ridge eagle in some part of my body.

1; among all day traders, nearly 40% day trade for only one month.

Citizens or resident aliens for the entire tax year for which they're inquiring.

Listed below are the nfl overall starting quarterback win/loss records for active nfl players that have started at least one game at quarterback. Regular season and postseason games are included in each player's totals.

A 73-year-old woman presents to your clinic complaining of unintentional weight loss. Where 41 residents (24 women with a mean age of 80 years) had recently lost fourteen out of 364 residents (4%) admitted with significant pre-exi.

England went on to win its first and only world cup that year. No shoes, no seeding although india qualified for the 1950 world cup in brazil, the team chose to withdraw from the competition.

Post Your Comments: